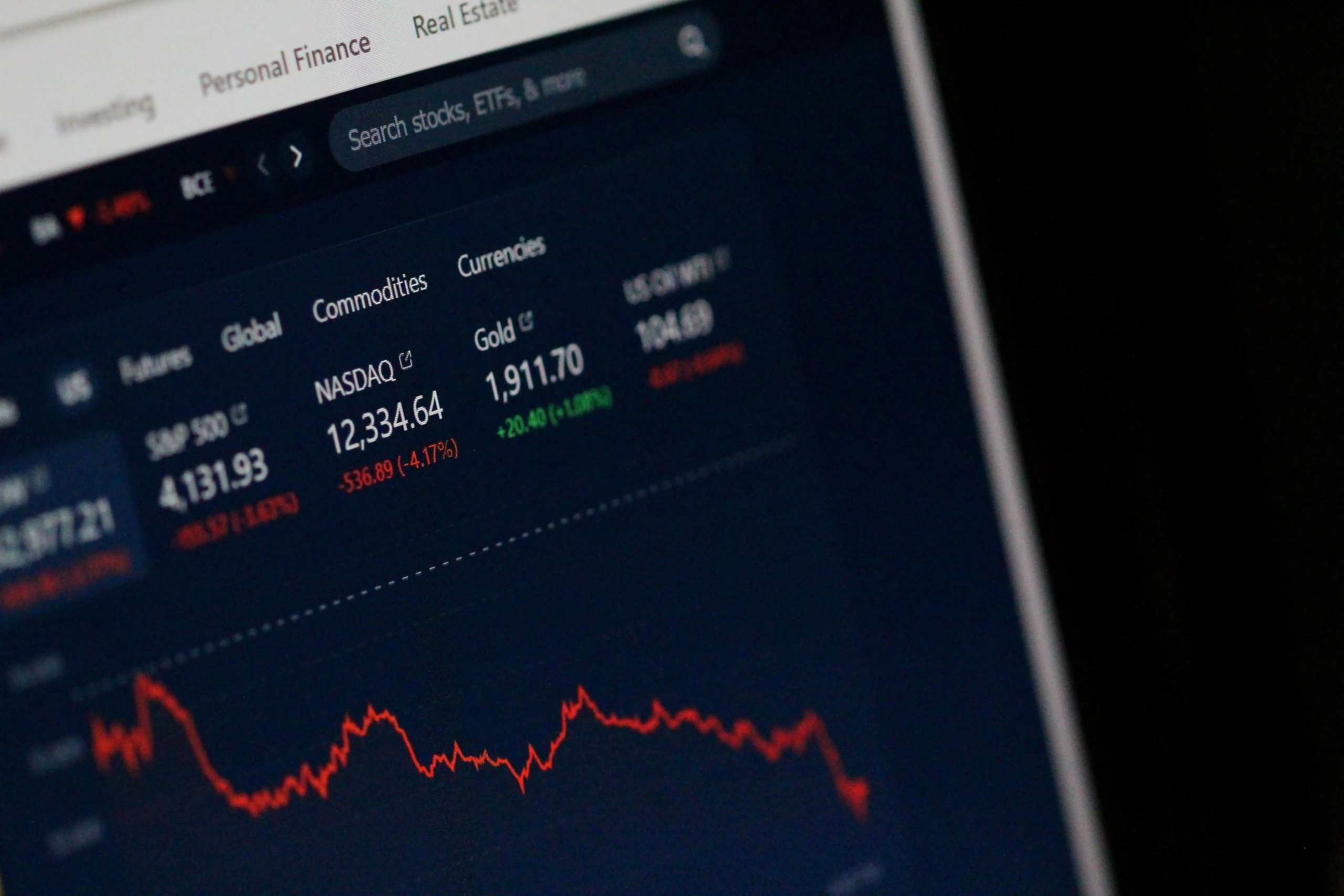

You can make a lot of money by picking and investing in stocks… but you can also lose a lot of money. Here’s how you can lose more money than you invest in the stock market!

Investing is always going to have some risk but picking stocks by yourself is more risky than a lot of people think. If you don’t know what you’re doing and things go horribly wrong you can actually lose more money than you invest.

Usually, you’d think you could only lose as much money as you put in when you make risky investment decisions. However, there are quite a few investment techniques and styles that could potentially make you lose more than you invested to begin with.

That’s right. There are worse things than your stock and investment going to zero.

Here are a few ways you could lose more money than you invested when you invest in stocks.

How you can lose money with short selling.

You can lose more money than you invest if you do something called “short selling” and fail. Short selling is when you borrow a stock, sell that stock and then buy back the stock you borrowed to give it back to your lender. Basically, you make the investment in the stock betting that it’ll go down in value.

How short selling is supposed to make you a profit:

Let’s say you short 100 shares of a company at $10 per share which means you have $1000 worth of shares. You sell them off and then owe your lender 100 shares of that company. If the share price of the company goes down from $10 to $2, you only need to pay back your lender $200 instead of $1000. You make a profit of $800 when you return the 100 shares you own to your lender.

How short selling can make you lose more than you invest:

Let’s say you get 100 shares of a company at $10 per share which means you get $1000 worth of shares. You do the same thing as the above example and sell them off which means you owe your lender 100 shares of that company. If the share price of the company goes up instead from $10 to $15, that means you now need to pay back $1500 instead of $1000. You lost $500.

This example is pretty mild because your potential for losses when short selling are uncapped. Imagine if the share price of a company you’re shorting goes up from $10 to $1000. Your potential for losses is pretty much unlimited.

As a reminder to anyone thinking about selling shorts, short selling is an advanced investment strategy that you should only be doing if you’re both highly experienced and have the cash to risk.

How you can lose money with leveraged investments.

Another way you can lose more money than you invest is by making leveraged investments that don’t work out. Simply put, leveraged investing is when you use borrowed money to invest with. You borrow money because you think you can make a big profit off a certain stock and want to use as much money as possible to capitalise off the opportunity.

If you make a mistake and make leveraged investments that don’t pan out, you’ll lose your money as well as the money you borrowed.

How leveraged investments are supposed to make you profits:

Let’s say you invest your own capital of $10,000 into a specific stock but are so confident you want to invest more. You take out a loan of $15,000 and then invest that into your stock pick. After a certain amount of time, you need to pay back your loan. You look at your stock pick and the $25,000 total investment you’ve made has grown to $100,000. You make a significantly higher amount of profits because you used leveraged investments.

Check out our article on Passive Investing Ideas.

How leveraged investments can make you lose more money than you invest:

Same amounts as the above example. You put up $10,000 of your own money and $15,000 of money that you’ve borrowed. However, in this example the stock you picked crashes down and your total investment goes down to zero dollars. Because you invested using leverage, you not only lost your own capital, you also lost the $15,000 you borrowed.

Leveraged investments are definitely profitable if you know what you’re doing. However, the risks are also high even if they’re not as high-risk as short selling. Always think twice about investing with leverage.

Protect yourself: How you can prevent yourself from losing too much money when you invest.

Once again, you always run the risk of losing money when you invest in stocks with the hopes of making a profit. However, you can take steps to make things less risky for yourself and stop yourself from losing all of your money or worse.

Diversify your investments:

Even if you have complete faith that a certain company will definitely go up in price, you really should diversify your investments to reduce the risk that you’ll lose money. If you buy a few different stocks, you’ll be less badly affected if one of them goes down in price.

Whether you choose to diversify your stock investments by buying a few different stocks in the same category or buying stocks in multiple different industries, please don’t put all your eggs in one basket by putting all the money you have into one stock. Doing that could go horribly wrong.

Make a few long term, safe bets:

While you can potentially make a lot of money quickly by day trading stocks, you’ll more than likely make losses along the way. If you don’t know what you’re doing, don’t do your research and don’t get enough experience, you will definitely lose more money than you make.

That’s why before you do anything too risky, you should make a few long term investments that are a relatively safe bet. While there are no truly risk free investments, there are many time tested, low risk investment options out there.

Put money into something like a low risk index fund before you buy more exotic and risky stocks. Index funds let you invest in numerous different individual stocks at once which will help protect you from losing too much money if your individual stock picks tank.

Learn from experienced investors and traders:

While you should never completely trust anyone who gives out stock or investing advice, you should definitely listen to experts and learn as much as you can from experienced investors and traders.

Do your own research and take calculated risks when you invest in the stock market. Read articles online about company news, read books written by experts and listen to interviews with experienced investors to broaden your knowledge of the stock market.

Check out our article on Content Writer vs Copywriter.

Closing

This article aims to help you understand the risks associated with specific investment techniques and encourage more general caution, not discourage you from investing in the stock market. You should definitely invest your money if you want to grow your wealth but you should not do anything that’s dangerously risky.

Good luck on your stock market journey!

Leave a Reply